Introduction:

Table of Contents

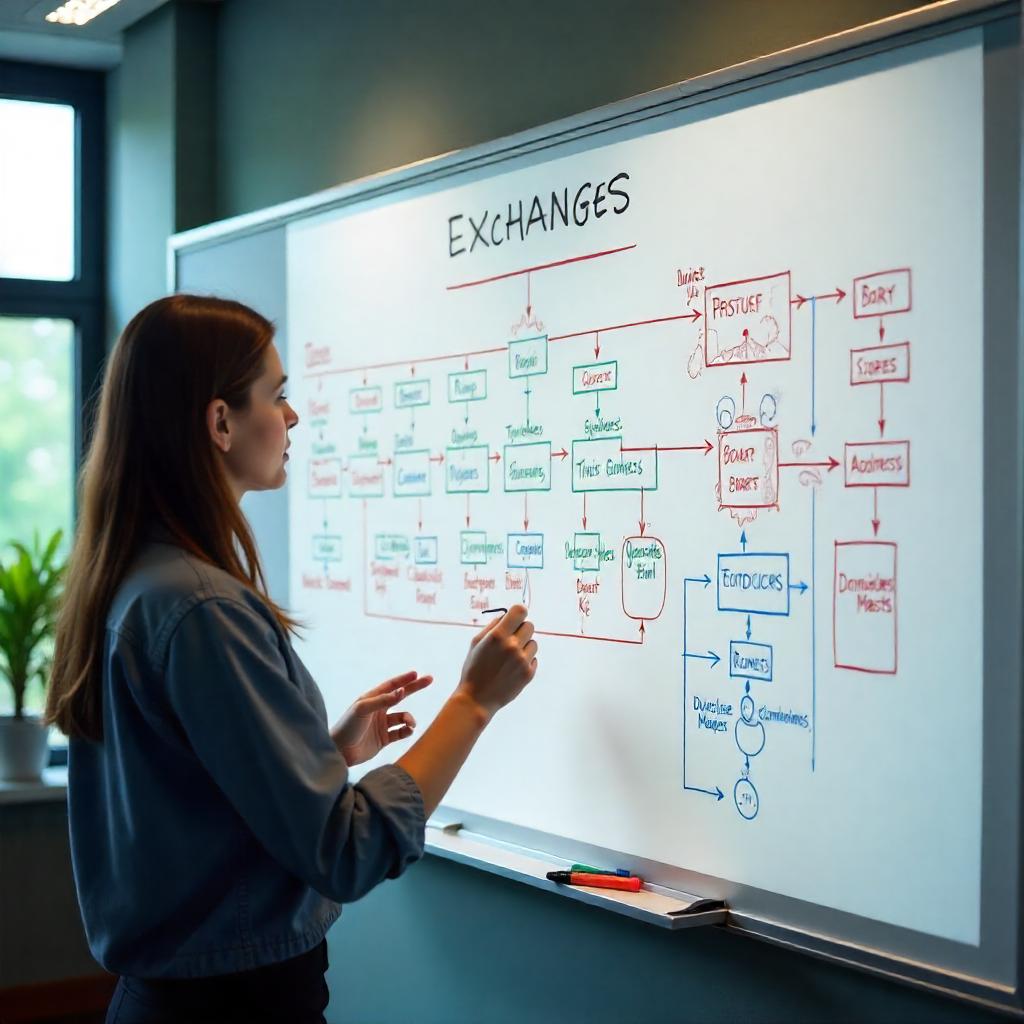

ToggleIn recent years, cryptocurrencies have gained immense popularity, transforming the financial landscape. With the rise of Bitcoin, Ethereum, and numerous altcoins, the need for efficient platforms to buy, sell, and trade these digital assets has surged. Cryptocurrency exchanges play a crucial role in facilitating these transactions. This article will provide a comprehensive overview of cryptocurrency exchanges, including their types, features, benefits, risks, and how to choose the right exchange for your needs.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital platform that allows users to buy, sell, and trade cryptocurrencies. These exchanges serve as intermediaries between buyers and sellers, providing a marketplace for digital assets. Cryptocurrency exchanges can be categorized into two main types: centralized exchanges (CEX) and decentralized exchanges (DEX).

Types of Cryptocurrency Exchanges

1. Centralized Exchanges (CEX)

Centralized exchanges are the most common type of cryptocurrency exchange. They are operated by a centralized organization that facilitates trading between users. Users create accounts on these platforms, deposit funds, and trade cryptocurrencies through an order book. Some popular centralized exchanges include:

- Binance: One of the largest exchanges globally, offering a wide range of cryptocurrencies and trading pairs.

- Coinbase: A user-friendly platform popular among beginners, known for its ease of use and regulatory compliance.

- Kraken: A well-established exchange with a variety of cryptocurrencies and advanced trading features.

Advantages of Centralized Exchanges

- User-Friendly: Centralized exchanges typically have intuitive interfaces, making them accessible for beginners.

- High Liquidity: These platforms often have a large number of users, resulting in higher trading volumes and better liquidity.

- Advanced Features: Centralized exchanges offer various tools and features, such as margin trading, futures, and staking.

Disadvantages of Centralized Exchanges

- Security Risks: Centralized exchanges are prime targets for hackers, and users risk losing their funds if the exchange is compromised.

- Regulatory Compliance: Centralized exchanges must comply with local regulations, which may require users to provide personal information.

- Custodial Control: Users do not have full control over their funds, as they must deposit them into the exchange’s wallets.

2. Decentralized Exchanges (DEX)

Decentralized exchanges operate without a central authority, allowing users to trade directly with one another through smart contracts. DEX platforms are built on blockchain technology, offering greater transparency and control over funds. Some popular DEX platforms include:

- Uniswap: A leading decentralized exchange that allows users to swap ERC-20 tokens directly from their wallets.

- SushiSwap: A community-driven DEX that offers additional features like yield farming and staking.

- PancakeSwap: A DEX built on the Binance Smart Chain, known for its low fees and fast transactions.

Advantages of Decentralized Exchanges

- Enhanced Security: Users retain control of their private keys and funds, reducing the risk of hacks.

- Privacy: DEXs typically do not require users to complete KYC (Know Your Customer) procedures, allowing for greater anonymity.

- No Central Authority: The absence of a central authority means that DEXs are resistant to censorship and regulatory interference.

Disadvantages of Decentralized Exchanges

- Lower Liquidity: DEXs may have lower trading volumes compared to centralized exchanges, resulting in less liquidity.

- Complexity: DEXs can be more challenging for beginners to navigate, as they require a basic understanding of wallets and smart contracts.

- Limited Features: While some DEXs are adding advanced features, they may not offer the same range of tools as centralized exchanges.

How to Choose the Right Cryptocurrency Exchange

Choosing the right cryptocurrency exchange is crucial for a seamless trading experience. Here are some factors to consider when selecting an exchange:

1. Security

Security should be your top priority when choosing an exchange. Look for platforms with robust security measures, such as two-factor authentication (2FA), cold storage for funds, and regular security audits. Research the exchange’s history to ensure it has a good track record regarding security breaches.

2. User Interface

A user-friendly interface is essential, especially for beginners. Choose an exchange that offers an intuitive design, easy navigation, and clear instructions for trading. A well-designed platform can significantly enhance your trading experience.

3. Supported Cryptocurrencies

Different exchanges support various cryptocurrencies. If you have specific coins in mind that you want to trade, ensure the exchange supports them. Additionally, check the availability of trading pairs to maximize your trading options.

4. Fees

Cryptocurrency exchanges charge various fees, including trading fees, withdrawal fees, and deposit fees. Compare the fee structures of different exchanges to find one that aligns with your trading habits. Keep in mind that lower fees are not always better; consider the overall value the exchange provides.

5. Liquidity

Higher liquidity ensures that you can buy or sell your cryptocurrencies quickly without significant price fluctuations. Look for exchanges with high trading volumes and a large user base to ensure better liquidity.

6. Customer Support

Reliable customer support is essential, especially if you encounter issues while trading. Choose an exchange that offers multiple support channels, such as live chat, email, and a comprehensive knowledge base.

7. Regulatory Compliance

Consider the regulatory status of the exchange in your jurisdiction. Ensure that the exchange complies with local laws and regulations to minimize potential legal issues.

How to Start Trading on a Cryptocurrency Exchange

Once you have chosen a cryptocurrency exchange, follow these steps to start trading:

Step 1: Create an Account

Visit the exchange’s website and click on the “Sign Up” or “Register” button. Provide the required information, including your email address, password, and any additional verification details.

Step 2: Verify Your Identity

Many exchanges require identity verification to comply with regulations. This process may involve submitting a government-issued ID and proof of address. Follow the instructions provided by the exchange to complete this step.

Step 3: Deposit Funds

After your account is verified, deposit funds into your exchange account. Most exchanges accept deposits in fiat currencies (e.g., USD, EUR) or cryptocurrencies. Choose your preferred method and follow the instructions to fund your account.

Step 4: Start Trading

Once your account is funded, you can start trading. Navigate to the trading section of the exchange, select the cryptocurrency pair you want to trade, and place your order. You can choose between market orders (buy/sell at the current market price) or limit orders (set a specific price for buying/selling).

Step 5: Monitor Your Trades

Keep an eye on your trades and the overall market conditions. Consider using trading tools and charts to analyze price movements and make informed decisions.

Step 6: Withdraw Funds

If you want to withdraw your funds, navigate to the withdrawal section of the exchange. Select the asset you wish to withdraw, enter the recipient address, and confirm the transaction. Be cautious when entering withdrawal addresses, as transactions are irreversible.

Risks of Trading on Cryptocurrency Exchanges

While cryptocurrency exchanges offer numerous benefits, they also come with risks. Here are some common risks associated with trading on exchanges:

1. Security Risks

As mentioned earlier, centralized exchanges are vulnerable to hacking and security breaches. Always prioritize security measures, such as enabling 2FA and using strong passwords.

2. Market Volatility

Cryptocurrency markets are known for their volatility, with prices fluctuating dramatically in short periods. Be prepared for price swings and consider using risk management strategies, such as stop-loss orders.

3. Regulatory Risks

The regulatory landscape for cryptocurrencies is constantly evolving. Changes in regulations can impact the operations of exchanges and potentially affect your ability to trade. Stay informed about regulatory developments in your jurisdiction.

4. Scams and Fraud

The cryptocurrency space has seen its fair share of scams and fraudulent schemes. Be cautious when dealing with unknown exchanges or projects, and conduct thorough research before investing.

Conclusion

Cryptocurrency exchanges are essential for anyone looking to buy, sell, or trade digital assets. Understanding the different types of exchanges, their features, and the risks involved can help you make informed decisions. By choosing the right exchange and following best practices for security, you can navigate the cryptocurrency landscape effectively. As the market continues to evolve, staying informed and adapting to changes will be key to your success in the world of cryptocurrencies.

Centralized exchanges are widely used for cryptocurrency trading, offering a straightforward way to manage funds and execute trades. Decentralized exchanges, on the other hand, provide more transparency and control by eliminating the need for a central authority. When choosing an exchange, it’s essential to prioritize security, user experience, and the variety of supported cryptocurrencies. Additionally, comparing fee structures and liquidity can help ensure a better trading experience. How do you decide which type of exchange—centralized or decentralized—is more suitable for your trading needs?

Pingback: Digital Currency Investment: A Comprehensive Guide To Navigating The Future Of Finance - Info Spher Hub